Carbon offsetting is a popular way for companies to claim ‘net zero’ greenhouse gas emissions, but this unregulated practice is fraught with complications and marred by scandal

By

For many years, companies have utilised carbon offsets to boost their green credentials. Yes, there are some greenhouse gas (GhG) emissions that we have not been able to eliminate, goes the narrative. But, by contributing financially to schemes elsewhere, which actually reduce levels of GhGs, it all balances out. That’s the idea, at least.

Carbon offsetting has been discussed at most of the COP conferences, ever since the inception of the international climate talks. In recent years, the issue has risen in prominence in national and international policy discussions. At COP28, which ended in December in Dubai with a watered-down commitment to ‘transition away from fossil fuels’, offsets were once again at the table, with a proposal put forward to regulate the market under the auspices of the UNFCCC (United Nations Framework Convention on Climate Change).

If successful, it would have been a hugely significant move. Carbon offsetting currently takes place under a wide range of different standards, with a slew of companies and auditors purporting to verify schemes and projects. It’s a loose system which has resulted in fierce criticism and has undoubtedly allowed shoddy schemes to slip through the net. International management and regulation under an existing body could reinvigorate the market, and make it more legitimate. Nevertheless, the proposal failed.

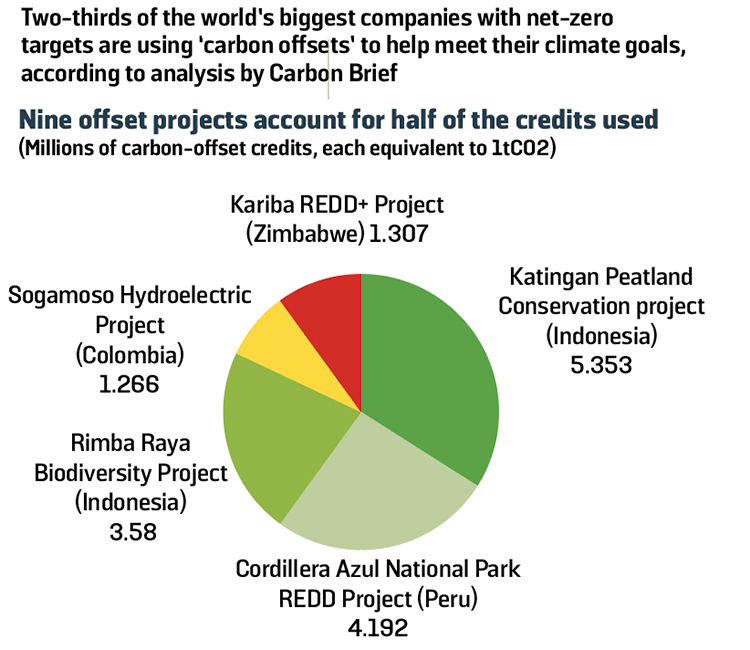

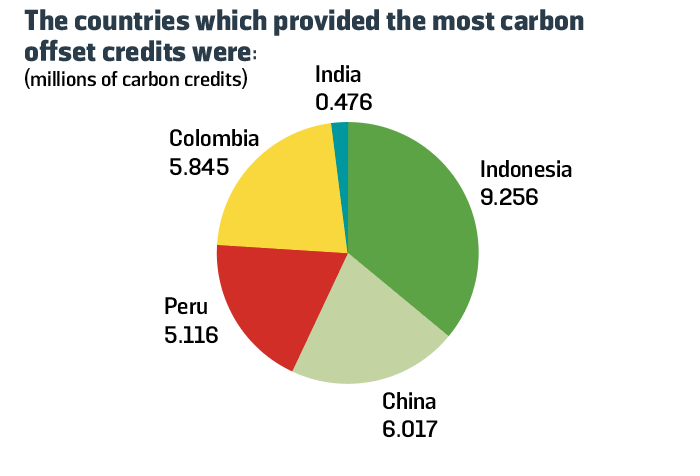

This leaves the world of carbon offsetting, and wider efforts to lower GhG emissions, in a precarious position. The appeal of offsets remains clear. Two-thirds of the world’s largest companies have indicated that they plan to use voluntary offsets to reach net zero, according to Carbon Brief. Oil and gas companies, airlines, fast-food brands, car makers, fashion houses, tech firms and universities all use them to lower their GhG emissions – on paper.

Offsetting is relatively simple for a company to execute and fairly cheap. It usually works by calculating unavoidable emissions and then purchasing credits, which have been awarded to projects verified for offsetting purposes. One credit is equivalent to one metric ton of carbon dioxide. Costs vary depending on the scheme – a high-tech project to remove carbon directly from the atmosphere and store it will cost much more than a forest protection scheme. But, on average, one tonne of carbon dioxide costs just £3 to offset.

Problems arise when it comes to proper accounting. For many schemes, it’s simply not possible to know how well they work and how much carbon they remove. In addition, many climate scientists and campaigners fear that carbon offsets provide a false sense of hope, reducing the imperative for industries to clean up. For some, it is little more than greenwashing.

‘People want to believe in carbon offsetting,’ writes Robert Watt, a lecturer in international politics at the University of Manchester, ‘because it offers to rekindle capitalism’s promise that we can enjoy consumerism without being too concerned about ecological crisis, by delivering a seductive story of power and status in which somebody else cleans up the mess.’ The truth, he asserts, in an article for the Conversation, is that carbon offsetting is a fantasy.

TOO GOOD TO BE TRUE?

Despite an increasingly negative perception of offsets in public spheres, there are still many people who regard the practice as a useful tool within wider efforts to tackle climate change. The fact remains that some emissions of GhGs cannot be eliminated completely, at least not yet. Steel, cement, heating, aviation, shipping – the technology hasn’t reached a stage where these industries, and all the industries that rely on them in turn, can do away with fossil fuels entirely.

On the other hand, there are many valuable schemes all around the world which lower GhG emissions, and are desperately in need of finance. Many of these are nature-based projects in developing countries, including tree planting and restoration of coastal habitats such as mangroves and sea grass (so-called blue carbon). Others aim to prevent the release of GhGs that otherwise might have occurred – those that protect at-risk forests from deforestation, for example, or those that promote regenerative agriculture techniques or distribute clean-energy stoves to people otherwise utilising fires. There is logic to the idea of linking these vital schemes with cash-rich polluters.

Scandals and scams: Shell

Offsetting projects in China, used and sold by energy giant Shell, came under fire in early 2023 for potentially shady accounting practices. The projects work to convince local farmers in China to use a sustainable rice farming method – the intermittent flooding and drying of rice paddies – designed to reduce methane emissions. But, according to an investigation by Climate Home News, the practice was already used in around 41 per cent of rice paddies around China in 2018, the year the carbon offsetting projects began. According to Quantum, a carbon market data provider, credits in Chinese rice farming projects have been traded for around $6, meaning that Shell may have pocketed up to $2.7m from their sale. Verra, which certified the scheme, is now carrying out a quality review of its rice farming offsets and Shell has indicated it is retreating from carbon offsetting altogether.

Even the strongest advocates of offsetting, however, admit there have been many problems. In fact, there have been so many controversies surrounding offsets it’s impossible to sum them all up succinctly. These issues range in severity. Some schemes have been exposed as outright scams, many of these related to tree-planting (trees have been cut down, emissions reductions vastly exaggerated, or a replanted group has been counted many times over for multiple credits). Others have been accused of harming Indigenous peoples in a bid to secure land for forest schemes, or overruling local wishes in the case of some hydropower projects.

There are also a whole host of issues that apply to pretty much all schemes and which are hard to overcome. One key problem is that while emissions of carbon dioxide last in the atmosphere for hundreds of years, having a warming effect the entire time, offsets are only as good as the length of the scheme chosen, and many schemes are vulnerable. Forests can burn down, land can be dug up, social and community schemes can come to an end. In addition, collateral damage isn’t unknown: protecting one area can push industries such as logging elsewhere.

Then there’s the fact that accurate accounting for many schemes is near impossible. This is particularly the case for schemes that purport to avoid the release of emissions (rather than removing them directly). Take a forest protection scheme. As you can never be sure that the protected land would have been damaged without the scheme in question, you can’t know how much carbon is being saved. There’s also the fact that the land may have ended up protected in any case. This notion – called ‘additionality’ in the carbon trading world – means you need to be absolutely sure that a project to reduce emissions would not have happened without the purchase of offsets.

Even direct carbon removal schemes are hard to quantify; nature simply doesn’t lend itself to strict accounting practices. Phil Williamson, an honorary reader at the University of East Anglia and Jean-Pierre Gattuso, a professor at Sorbonne University, study the interaction of marine life, chemistry and the climate.

In a 2022 paper, they cast grave doubt on the effectiveness of carbon removal by blue carbon schemes (such as restoring mangroves in order to sequester carbon), noting that while such projects are highly advantageous when it comes to adapting to climate change, protecting coasts and supporting biodiversity, they are unreliable when it comes to carbon removal. ‘Many important issues relating to the measurement of carbon fluxes and storage have yet to be resolved, affecting certification and resulting in potential over-crediting,’ the study concludes.

Source: Carbon Brief, September 2023

Several big companies have found themselves in embarrassingly hot water over their choice of offsets, most notably French energy giant Total, which announced in 2021 that it had delivered its first shipment of ‘carbon neutral liquid natural gas’. Emissions from transporting the cargo were partly offset by investing in a wind farm in China, but further investigation revealed that the wind farm had been operating since 2011 and had already issued more than two million tonnes of carbon credits, making it unlikely that the recent purchases resulted in additional removal of carbon.

The company also offset its shipment by supporting a scheme in Zimbabwe in which villagers clear brush near the thickly forested border with Mozambique. This work can help prevent deforestation through the spread of wildfires. While the scheme may well have merits on a local level, Danny Cullenward, a Stanford University lecturer and policy director at CarbonPlan, told Bloomberg: ‘The claim that you can market the sale of fossil fuels as carbon neutral because of a meagre few dollars you put into tropical conservation is not a defensible claim.’

Responsible offsetters will look to use schemes that have at least been verified by reputable organisations, operating good industry standards. However, even this is no guarantee of quality. There is no one international body overseeing offsets (though many would like to see one). Instead, a patchwork of industry standards exists, the largest one being the Verified Carbon Standard (VCS), developed by US-based non-profit Verra, which approves three-quarters of all voluntary offsets.

Verra, however, has received its fair share of criticism. A 2023 investigation by The Guardian and Corporate Accountability, a non-profit, transnational corporate watchdog, analysed the top 50 emission offset projects and concluded that 78 per cent were likely ‘junk or worthless’. This categorisation was awarded to a scheme where there was ‘compelling evidence, claims or high risk that it cannot guarantee additional, permanent greenhouse gas cuts among other criteria.’ In some cases, there was even evidence suggesting that projects were leaking greenhouse gas emissions or shifting emissions elsewhere. Almost two-thirds of the most traded projects were certified by Verra.

MAKING OFFSETS WORK: MICROSOFT

Piers Forster, a professor of physical climate change at the University of Leeds, points to Microsoft as a company working hard to carefully calculate offsets and ensure they have a long-term benefit. Acknowledging that in the past, the company has achieved ‘carbon neutrality’ primarily by investing in offsets that avoid emissions instead of directly removing carbon, it has announced a shift in focus towards direct carbon removal and ‘carbon negativity’.

As direct carbon capture from the atmosphere is a technology still in its infancy, Microsoft has committed to investing $1 billion over the next four years into new direct carbon capture technologies. Climeworks is currently the leader in direct carbon capture and the two companies signed a ten-year deal in 2021. Climeworks technology works by drawing air into a collector using fans. Once sucked in, air passes through a filter located inside the collector which traps the carbon dioxide particles. When the filter is completely full, the collector closes, and the temperature rises to about 100°C. This causes the filter to release the CO2 which is collected and stored underground by partner organisation Carbfix, based in Iceland.

MAKING OFFSETS WORK

Could offsetting be made to work? Piers Forster, a professor of physical climate change at the University of Leeds and a member of the Climate Change Committee, (CCC), the UK’s independent climate change advisory body, remains cautiously optimistic. Taken as whole, he believes carbon offsetting has had a net benefit, despite its issues. ‘Public perception is probably worse than the reality,’ he says. ‘There are a lot of good things going on in different countries that are benefiting greenhouse gases, and also benefiting biodiversity and community.’

It is certainly true that many projects verified for use in offsetting schemes come with multiple benefits. A scheme to disseminate cleaner cooking stoves to villagers in Mexico, for example, will still reduce deadly air pollution even if wider carbon offsetting calculations don’t add up.

As a member of the CCC, Forster is responsible for penning advice to the UK government, including on the ways in which offsetting could be improved. The first and most important point the CCC makes is that carbon offsetting should never be the main priority of businesses. Reducing emissions as far as possible must always come first.

In its most recent report, the CCC called on the government to establish ‘net zero’ as a statutory definition: ‘to ensure businesses don’t claim the term based on an inappropriate reliance on offsetting’. It also suggested that businesses should be required to disclose why carbon credits are being used rather than direct emissions reductions.

Once this is done, Forster still thinks offsets could play a useful role. In fact, it can be a loss when companies pull away from offsetting as a result of negative public perception. Companies such as Shell have indicated they will move away from offsets, following a number of high profile scandals (see box). EasyJet have taken a similar approach, choosing to focus on emissions reductions instead.

‘Last year I was in Rwanda and it was announced that EasyJet had pulled out of its forest protection scheme,’ says Forster. ‘The Rwandans wanted long-term support to restore their rainforest and support their communities and they were upset with EasyJet for pulling out. Perhaps offsets weren’t perfect, but they were definitely doing good in that country.’

What it really comes down to is the need for a better system of regulation and oversight. ‘I think a lot of the crediting organisations and auditing organisations are really trying to do a good job,’ says Forster. ‘But they also seem to be selling the product they are auditing. That’s something that will eventually have to change.’

This is an issue many critics raise. According to Watt, writing in the Conversation: ‘Grave uncertainties in the accounting process are exploited by project developers, overlooked by standards agencies, and forgotten by auditors. These actors all have conflicts of interest – developers want to sell more credits, while standards agencies and auditors want to gain market share. The resulting credits they certify are offered as a cheap means to appear green.’

Positive change could be coming. New guidelines for a ‘good’ carbon credit programme were announced in March 2023 by the Integrity Council for the Voluntary Carbon Market (ICVCM), an initiative that aims to reassure buyers about the quality of offsets they are buying. To get the ICVCM stamp of approval, carbon credit certifiers such as Verra will have to demonstrate that projects are compatible with a transition to net zero, are permanent (projects must compensate for any reversals that happen within 40 years), are additional (reductions and removals would not have happened without carbon credit revenue), and robustly quantified (the emissions impact must be measured conservatively to minimise the risk of overestimation). The new standards are not yet in practice but are in development.

COP28, however, was undoubtedly a missed opportunity. A deal designed to establish a formal voluntary trading scheme under the auspices of the UNFCCC failed to cross the line. During protracted, late-night negotiations, two entrenched sides emerged. The EU were in support of and pushed for the UN-based scheme. The US, supported by a majority of nations, favoured a system based on the private verification companies already operating.

‘It was a disappointment,’ says Forster. ‘The split between them seems incredibly ideological. The EU are fond of big government regulation, and the United States is fond of privatisation. I think the truth is that without the UNFCCC deciding on the best course of action it will create a big vacuum where people think they can do whatever they want to do. It’s quite disappointing that the US and EU and some other countries can’t work towards a solution.’

Scandals and scams: Boeing, Air France and Liverpool Football Club

Prosecutors in the Amazonian state of Pará have filed lawsuits against three carbon credit projects, alleging that the companies behind them seized public land for use in their forest protection schemes. The credits were verified by Verra and sold to several Western companies including Boeing, Air France and Liverpool Football Club. NGOs have long complained about schemes that employ aggressive behaviour towards local and indigenous communities in order to secure land.

A RELATIVELY SMALL ROLE

In its most recent report, the CCC advises the UK government that businesses should be encouraged in voluntary action that goes ‘beyond value chain mitigation’, such as ‘purchasing carbon credits without claiming the reduction in emissions’. Such a system effectively downplays offsetting as an effective net zero strategy, or at least recognises it as flawed, while still encouraging companies to financially support the type of schemes involved in current offsetting plans: donation rather than offsetting. It might offer a simpler path.

COP28 left the world of offsets exactly where it was before the conference – outside of any international body and operating according to a wide range of standards. For now, then, conscientious companies looking to offset should be cautious. Climate experts and scientists continue to urge what they have always urged: focus on cutting emissions as much as possible. Offsetting should only be done within a coherent and transparent net-zero plan. ‘I think the most important thing to do is to talk about offsetting always within the context of your overall decarbonisation journey,’ says Forster. It must never be a replacement for direct action to lower emissions.