In a globalised world, are tariffs shaping the future of trade, or is a deeper transformation already underway?

By

Welcome to the new age of global trade, where old certainties are fading and new patterns are emerging with seismic effect. While headlines fixate on US President Trump’s tariffs and their immediate repercussions, a quieter, more enduring shift is taking place. Global trade is no longer a story solely dominated by traditional powers, but increasingly shaped by the rise of the Global South, the reconfiguration of supply chains, and the forging of new regional alliances.

Indeed, the architecture of trade built in the post-war years is being redrawn. According to Andrew Mold of the United Nations Economic Commission for Africa (UNECA), trade between developed countries – so-called north–north trade – has declined by nearly 15 per cent since 1995. Meanwhile, south–south trade has grown by more than 14 per cent, a remarkable shift that reflects the increasing economic clout of emerging nations.

Although north–north trade still represents the largest portion of global commerce, the trend lines are unmistakable: a multipolar trade world is rapidly emerging.

China, the world’s leading trading nation, exemplifies this shift. It’s now the largest trading partner for 120 countries, primarily across Africa, Latin America and Asia. Its global trade surplus reached nearly US$1 trillion in 2024, underlining the scope of its reach.

China’s Belt and Road Initiative and a string of bilateral trade deals have deepened ties with many nations, offering infrastructure in exchange for long-term trade loyalty. This isn’t merely commerce, but a recalibration of geopolitical influence. The US imposition of a 104 per cent tariff on imported Chinese goods in April is more than likely to accelerate this trend. China will continue to enhance its economic reach through deeper cooperation with emerging markets.

‘The intention of the US administration seems to be to reintroduce a pre-world war reciprocity in trade. It looks like we are in for a bumpy ride. I’m seeing a lot of pessimism and it’s hard not to feel that myself.’

Amrita Saha, University of Sussex

Africa, too, is assuming a central role in this transformation. By 2050, one in four people on Earth will live on the continent. Its youthful demographic profile and rising middle class offer a tantalising vision of future economic power. Already, intra-African trade is gaining momentum, supported by new agreements such as the African Continental Free Trade Area. While the continent isn’t yet a dominant force in global trade, the potential is undeniable. ‘If investment flows into value-added sectors and services, Africa could become a major engine of global growth,’ says Maximiliano Mendez-Parra of the Overseas Development Institute.

‘The Gulf states, the UAE, Qatar and Saudi Arabia, are investing in Africa,’ says Mendez-Parra. ‘So a lot of nations in Africa definitely have alternative options. Many African nations have reoriented trade to China in the past two decades, exporting minerals that China needs in return for infrastructure investment.’ According to UNCTAD data, 20 per cent of Africa’s exports go to China, while 16 per cent of its imports come from China. According to Mold, 2023 UNCTAD data shows that, out of ten African export sectors, only three (automotive, primary products and textile, garment and footwear) depend more on international markets than continental markets; others, including electronic and electrical manufacturing, processing, high-technology exports, engineering manufacturing and agriculture, trade far more internally across the continent.

Yet this won’t translate quite yet into the necessary financial muscle. ‘Intra-African trade is rising in importance but African trade to the USA is still significantly larger,’ says Mendez-Parra. ‘African trade is not yet a centre of global trade – but it might be in 25 years.’ Within Africa, value-added and manufacturing trade currently account for 17 per cent of all trade, according to Mendez-Parra; in Asia, that figure is 50 per cent. ‘If the investment comes in the right sectors – value-added, services, manufacturing – it might be the engine that pulls the rest of the global economy,’ he says.

These developments are redefining how countries interact. The traditional model of rich countries exporting finished goods to poorer nations in exchange for raw materials is crumbling. Countries such as Indonesia and Turkey, now classified as middle- income, are building complex, mutually beneficial trade relationships with a range of partners, from China to the EU. This diversification offers resilience in an era of geopolitical volatility. However, the new tariffs from the USA are prompting these nations to consider recalibrating their trade strategies even further.

For decades, the world has been governed by WTO rules and free trade blocs such as the EU, NAFTA, ASEAN, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and, in South America, Mercosur.

Yet the changing nature of trade is always influenced by the geopolitical context within which it occurs. ‘The tacit agreements that prevailed for the past 60 years or so are being questioned,’ says Mendez-Parra. ‘I don’t think that what Trump is trying to do is going to work. The tariffs are not going to be effective – but that does not mean they are going to be harmless.’

An age of obeying rules for mutual benefit, if not maximum short-term national gain, may be dissolving, he suggests. ‘We have become used to a system with global rules that people more or less respected, a system that delivered peace settlements. If you don’t have such restraining mechanisms then you only have to look at the previous 5,000 years of history to see what happens.’

Reducing deficits

Behind the rolling of eyeballs and discreet diplomatic sneering, there is a haunting fear that there may be a rationale to Trump’s behaviour – that his actions may be symptoms of a new era, rather than the ephemeral whims of the current White House incumbent. Many tariffs imposed by Trump in his first term were mostly continued or – in the case of China – expanded by his successor, Joe Biden. Under both Trump’s first term office and Biden, the USA has dropped partnership talks from Asia to Europe and signed no new trade deals. In the same time, China negotiated nine deals, the EU eight.

‘I don’t think that what Trump is trying to do is going to work. The tariffs are not going to be effective – but that does not mean they are going

Maximiliano Mendez-Parra,

to be harmless.’

the Overseas Development Institute

In other words, Trump is no outlier. ‘If you think about it in simple economics, tariffs generate revenues – the USA is looking to reduce its trade deficit. You can reduce deficits, even if that raises prices,’ says Amrita Saha of the Institute of Development Studies at the University of Sussex. In early April 2025, Trump announced sweeping new tariffs, including a 54 per cent duty on Chinese goods, a move that drew international condemnation and rattled global markets.

During the first weeks of his presidency, it was difficult to discern a consistent message. However, these latest actions suggest a doubling down on protectionism. Canadian Prime Minister Justin Trudeau described Trump’s move as ‘dumb’; China threatened it would ‘fight a trade war, any war’ to the end.

At UNECA, Mold has pointed out that adjustments in trade tariffs will have knock-on effects in labour markets globally, ‘where workers as well as consumers may face the consequences.’ The risk impact is mainly on lower-income people, who tend to buy more goods than services (for example, school shoes rather than overseas holidays).

‘The answer to the question of who pays the cost of tariffs is not straightforward. In response to tariff hikes, buyers and sellers adjust their prices. How they respond and how these price changes then affect supply chains and final consumers,’ says Saha.

When such norms are being shaken, the path to a different but nevertheless secure world order becomes uncertain, suggests Saha. The changing nature of trading blocs may appear irreversible but are subject to disruption by the individual in the White House, she cautions. ‘[Trump] is redefining what are considered norms and the risk is this could lead to the international trading system as we know it collapsing,’ she says. ‘Large developing countries or large coalitions can retaliate – but the bigger question is whether this would faze Trump. The intention of the US administration seems to be to reintroduce a pre–World War reciprocity in trade. It looks like we are in for a bumpy ride. I’m seeing a lot of pessimism and it’s hard not to feel that myself.’

Tariffs, particularly those imposed by the USA under Trump and continued in part by the Biden administration, have reshaped trade flows. Steel, aluminium and agricultural products have all been caught in the crossfire. In some cases, targeted countries have responded with equal force, imposing their own tariffs and seeking new alliances. Canada and Mexico, for example, recalibrated their positions in response to US pressure, choosing measured diplomacy to maintain access to their largest trading partner.

But the effectiveness of such tariffs is debatable. The USA, with its diverse and largely self-sufficient economy, may absorb some of the pain, but for smaller economies, the ripple effects are harder to mitigate. As Saha points out, supply chains are now so interlinked that a tariff in one region can have knock-on effects globally, disrupting industries far from the point of imposition.

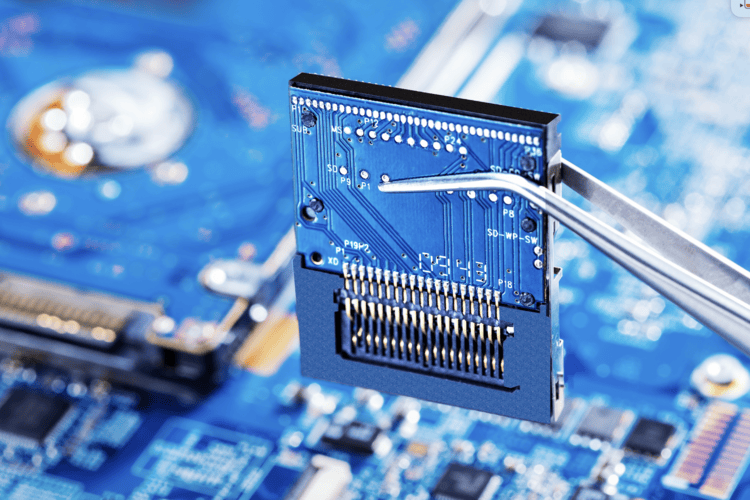

Indeed, the structure of global trade has become astonishingly intricate. Gone are the days of straightforward commodity exchanges. Modern trade relies on value chains that span continents – a smartphone assembled in China might contain parts from Korea, software from the USA and rare minerals from Africa. Tariffs and trade wars can, therefore, act as blunt instruments in an ecosystem that rewards cooperation and integration.

This complexity suggests that 21st-century trade disputes demand 21st-century solutions. Retaliation may satisfy domestic political pressures but often comes at the expense of global efficiency. More promising are coalitions based on shared interest, such as potential alignments between the EU, Canada and other nations committed to multilateralism.

The rise of regionalism also plays a crucial role. Trade blocs such as ASEAN, the CPTPP and the African Continental Free Trade Area are becoming increasingly relevant, reflecting the pivot from global to regional supply chains. As countries seek to insulate themselves from external shocks, these blocs may offer the stability and predictability that the multilateral system is struggling to provide.

What does all of this mean for the future? One possibility is a world where no single country dominates trade. Instead, we may see overlapping networks of influence, with trade routes crisscrossing new centres of production and consumption. For those that can adapt, the rewards may be substantial. For those clinging to past models, the future may look increasingly uncertain.

AID FOR TRADE

Tariff impacts on the poorest

Globalisation has been beneficial for many countries, but developing nations have benefited proportionately more than higher-wage economies. Between 1990 and 2023, more than one billion people exited poverty, according to UNCTAD data. Tariffs can force governments to change tack, either in policy or where they trade, but they will always have disproportionate impacts on the poorest, according to a 2025 paper published by the Institute of Development Studies at the University of Sussex.

The poorest households consume mostly tradable goods such as cooking oil and basic textiles as a share of their income, and therefore increases in consumer prices can have a larger negative impact,’ the paper concluded.

The paper focused on the concept of Aid for Trade (AfT) and highlighted OECD estimates that an extra US$1 invested in AfT generates an additional US$8 of exports for all developing countries, and US$20 for low-income countries.

Changing the parameters of AfT, or disregarding AfT completely, has huge ramifications and will influence the ability of the poorest to take advantage of positive opportunities or cope with losses that are generated from trade. ‘In the context of low- and middle-income countries, the poorest and most disadvantaged are not a small proportion of the population – women and young people in precarious work, people with disabilities, and Indigenous populations,’ says IDS’s Saha. ‘The costs of adjusting are unevenly distributed across people according to their skills and ability to move into other sectors,’ she says.

‘We’re not just talking about trade anymore – we’re talking about a complete rethinking of how the world connects’

Amrita Saha, University of Sussex

Trump’s tariffs may grab the headlines, but they are the surface disturbance atop deeper, more powerful currents. The real story of global trade in the 2020s is one of transformation – of old hierarchies giving way to a new order defined not by dominance, but by interdependence.

As Saha puts it: ‘We’re not just talking about trade anymore – we’re talking about a complete rethinking of how the world connects.’

Middle-income nations

Which way to turn?

Turkey and Indonesia are just two middle-income nations to have benefited from trade liberalisation in recent decades. Turkey has enjoyed a customs union with the EU since 1995, which lifted the nation into the top 20 global exporters. Around 50 per cent of Turkey’s exports go to the EU, just 19 per cent to the USA.

While Turkey’s president Recep Erdoğan has enjoyed a bumpy ‘bromance’ with Trump – despite their mutual masculine persona, tariffs have inserted a spoke in the two nations’ trade wheel. The first Trump administration slapped 25 per cent tariffs on iron and steel imports from Turkey, then doubled it, leading to a 23 per cent drop in exports from Turkey to the USA. Turkey retaliated with tariffs on cars, nuts and spirits, rice and beauty products, which cut US exports to Turkey of these products by almost half between 2018 and 2023.

Indonesia, meanwhile, has built up a strong relationship with China, which has been its largest trading partner – accounting for 25 per cent of total trade – for a decade. China also accounts for 28 per cent of Indonesia’s imports. Indonesia’s chief exports to China include iron, steel, mineral fuels and edible fats, worth US$71 billion in 2023. China sends nuclear reactors and related infrastructure and electrical machinery the other way, to a value of US$63 billion in 2023. Indonesia’s trade with the USA is far smaller but it enjoys a surplus, having imported US$10.2 billion of goods from the USA in 2024, and exported US$18 billionto the country. Even so, Amrita Saha of the University of Sussex believes Indonesia and Turkey, despite appearing to have the upper hand over the USA in trade terms, need to play their cards judiciously. ‘I think that standing up to the USA will require these economies to form larger coalitions – for instance, with the EU/UK and Brazil.’

Image: Jakarta, the thriving Indonesia city. Shutterstock