In Wales, Scotland and Northern Ireland, miners are looking to the hills and mountains for viable gold deposits. Laura Cole asks why the hunt for the yellow metal has returned to the United Kingdom

By Laura Cole

Pubs are a good place to overhear tales about gold in the valley. Roger Marr runs the Cross Keys Inn in the former slate town of Dolgellau, north Wales, and every so often, an amateur gold panner shows up at his bar, raising a hand and tilting it so as to show off a ring between sips of beer. ‘They’ll make one from melted-down pieces they find in the rivers,’ Marr says, ‘but it can take years to find enough of the stuff.’

If you’re after gold, Dolgellau is the place. The Snowdonian town of 3,000 people sits in the crook of a gold belt that extends from the wide sands of Cardigan Bay then bends like an elbow northwards for another eight miles and finally peters out under the crumpled mountains. During the mid-1800s, a gold industry developed around two mines here, Gwynfynydd and Clogau, reaching its peak in the 1900s. These days, the belt is largely unknown except to the panning enthusiasts, who slosh about in the shadows of boulders and in the slower water, where the metal is more likely to sit. ‘We have one Italian panner who comes to drink here every year,’ says Marr. ‘He goes up to the mountain for a month and comes back with enough to pay for the flight home.’

Stay connected with the Geographical newsletter!

In these turbulent times, we’re committed to telling expansive stories from across the globe, highlighting the everyday lives of normal but extraordinary people. Stay informed and engaged with Geographical.

Get Geographical’s latest news delivered straight to your inbox every Friday!

Such stories are exciting, especially during a quiet winter; however, even the most deft panner would admit it’s difficult to make any money through the practice, even with gold’s current high value. This is partly due to panning’s iffy legality – you can’t sell what you find – but mainly because it’s simply not fruitful enough. The gold in the streams is rarely found in nugget form. Typically, it’s pinhead-sized fragments that are flushed from the larger lodes locked up in the rock. Most agree that to make any money from Welsh gold would take the return of a commercial operation.

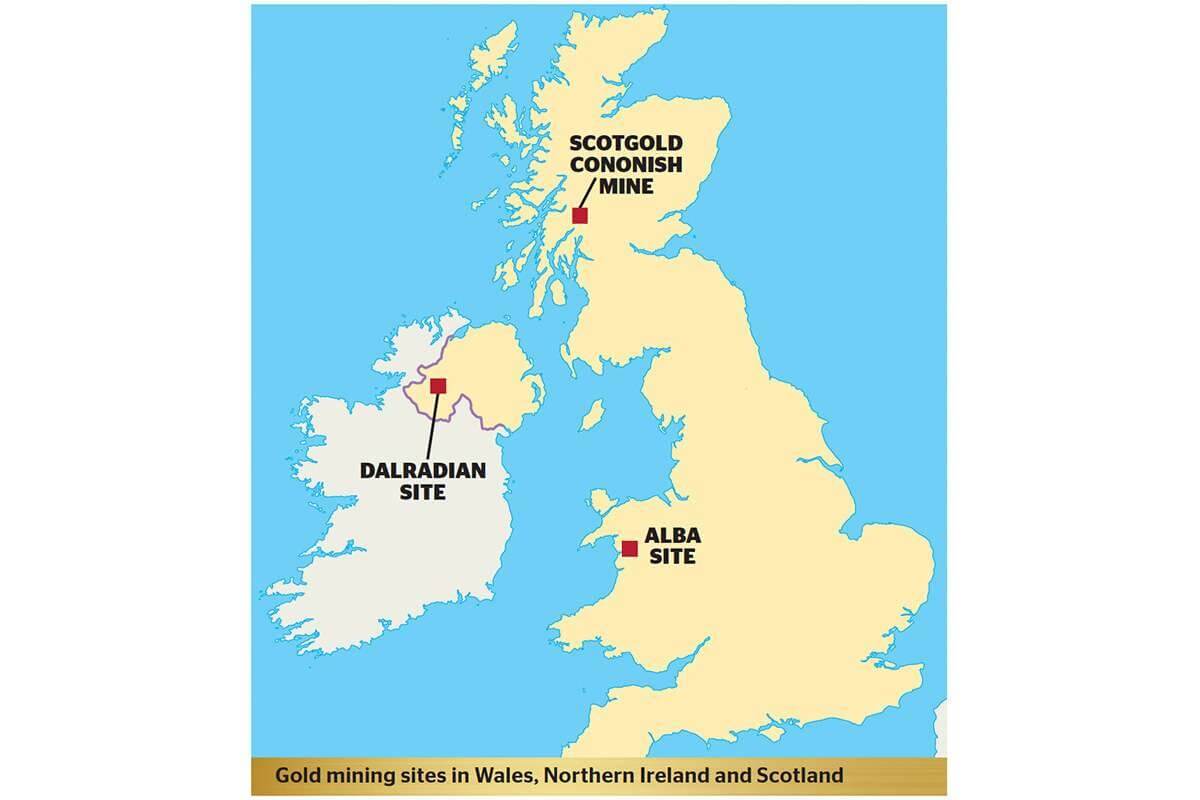

But the panners are no longer alone in their search. At the end of 2020, mining company Alba Mineral Resources purchased the Gwynfynydd mine, a move that granted it access to the entire gold belt. Amid a wider Covid-related slowdown of mining and exploration activity, its plan to bring gold mines back to Snowdonia’s mountains could seem exceptionally ambitious. However, it isn’t the only commercial gold project getting underway in the UK. Rocks under the Sperrin Hills in Northern Ireland and the Grampian Mountains in Scotland are also being sampled, drilled and blasted for their golden innards. It’s no coincidence that the projects all appeared at once.

Starting to search

Gold miners are feeling positive. ‘This is the start of the Scottish gold mining industry,’ says Richard Gray, CEO of Scotgold, speaking from the Grampians. ‘This is the most significant discovery in decades,’ says George Frangeskides, executive chairman of Alba Mineral Resources in Wales. And in Northern Ireland, Patrick Anderson, CEO of Dalradian, says his project, based at Curraghinalt in West Tyrone, has transformed ‘from a small, early-stage deposit to one of the best gold projects on the planet’. Each company has its own claim to hyperbole. The Dalradian project claims to sit on the largest gold deposit in Europe; Scotgold plans to open Scotland’s first gold mine; and the Welsh land was once the most productive in the UK and is thought to contain tantalising ‘bonanza’ deposits, where gold exists in potentially game-changing concentrations.

The locations of these projects add up to a rough map of all known UK gold deposits. In Scotland and Northern Ireland, geologists are tapping into the Dalradian supergroup, a band of rock that crosses the top of the UK diagonally, like a sash, from Northern Ireland, under the Irish Sea and on to the Grampians. Most of this is sedimentary rock that accumulated 500–800 million years ago when the region was part of the shallow sea fringe of the ancient continent of Laurentia.

The sedimentary bedrock of the Dolgellau belt formed on a separate continent, Avalonia, around 500 million years ago, when what is now north Wales was a sea basin. Eventually, tectonic forces caused these two continents to crunch together, pushing up the Welsh basin and the Scottish Highlands.

What all of the formations have in common are veins of quartz – the milky threads found in many rock types. These are formed when superheated liquids pulse upwards from deeper in the Earth’s crust, usually during mountain-building events, and infiltrate the host rocks’ pores, cracks and fissures. The liquid precipitates into quartz, along with any metals that have hitched a ride. It’s within these often illogically shaped deposits that real gold can be found.

Each of the UK gold mining projects is hunting for quartz veins, albeit at slightly different stages of development. Alba’s Welsh project is the newest and provides a good example of the early stages. Since the company bought a majority share in the Clogau mine in 2018, it has made regular exploratory forays. Beyond the entrance – an old-fashioned hole in the wall under a leafy overhang – lie 20 miles of caverns, some with quartz veins up to 15 metres thick. ‘We’re chasing them into Clogau mountain,’ says Frangeskides, ‘and we’re looking for possible mine extensions.’

The hunt also occurs from above. Alba has hired geologists to scope the topside mountain fields and search for undiscovered patches of gold. Workers dig trenches to get at the bedrock and drill into it for signs of the quartz veins that run underneath.

One hundred and eighty-six miles to the northwest, Dalradian in Northern Ireland has submitted a planning application to begin blasting for a mine in 2022 that will last two decades. Meanwhile, Scotgold’s Cononish project is the furthest along. By the end of 2020, it had collected and crushed enough quartz to begin production. In December, at a processing building in the drizzly glen, a technician poured molten gold to produce a 999.9-purity piece of the metal.

If all three projects achieve their ambitions, there will be gold dug out of single mines in Snowdonia, the Grampians and the Sperrin Mountains within three years. Beyond that, each company has visions for further growth. Scotgold has secured an agreement to explore 13 other areas in the Highlands; Dalradian’s Anderson has spoken of expanding to more than one mine in Northern Ireland; and in Wales, Alba has discovered ten ‘promising’ areas near to the original mine and is looking for more. ‘It is not in the realm of fantasy that we will find one or more significant virgin gold deposits through this work,’ says Alba’s chairman Frangeskides. If the trend continues, gold locked under the UK will become available to buy. What then?

Safe havens

On 24 July 2020 the gold market had an extraordinary afternoon. At the second of two daily teleconferences among banks, which take place to fix the price of gold in a way that reflects supply and demand, there was fresh anticipation. For several days, the price had been nearing US$1,895 per ounce, the all-time historical high. With the closing words ‘there are no flags, we’re fixed’ – a hark back to the days when objections were signalled by raising a tiny Union Jack – the price broke its record. And it didn’t end there. There was already speculation that gold could hit US$2,000 an ounce, riding the 30 per cent rush in demand it had enjoyed all spring and summer. By 6 August 2020, the price peaked at US$2,061. Demand was soaring.

‘Gold has once again proved to be the safe haven of choice in periods of high uncertainty and high volatility,’ said Ruth Crowell, CEO of the London Bullion Market Association. Her comment spoke straight to gold’s key value to investors – as a safe bet during economic upheaval. In line with the financial fallout of Covid-19 and waning faith in the strength of currencies, banks and private investors were buying it up in the hope of securing some stability. This was to be expected. Gold’s value is often inversely related to that of the US dollar, a fact that sets it up for headlines such as ‘Gold price soars as virus spreads’ and ‘Gold rises with US-China tensions’. As the US novelist John Updike wrote, ‘The beauty of gold is, it loves bad news’. The yellow metal is renowned in the market for its cynical sheen.

Subscribe to our monthly print magazine!

Subscribe to Geographical today for just £38 a year. Our monthly print magazine is packed full of cutting-edge stories and stunning photography, perfect for anyone fascinated by the world, its landscapes, people and cultures. From climate change and the environment, to scientific developments and global health, we cover a huge range of topics that span the globe. Plus, every issue includes book recommendations, infographics, maps and more!

Is the gold price responsible for the new mining projects? Yes and no. The success of a new gold mine is related to the price of gold, but not immediately. According to the World Gold Council, most mines take ten years to become productive – too slow to be able to jump on the back of an unprecedented pandemic.

Nevertheless, Scotland’s gold story has paralleled price peaks and troughs. A mine was first attempted by a different company in the 1980s (when, adjusted for inflation, the all-time highest gold value was reached due to a recession), but failed when the price subsequently crashed. Scotgold first had success ten years ago in the aftermath of the financial crisis (exploring started in 2008). Dalradian, similarly, began its exploration of the Sperrins back in 2009, when the price was high. ‘And that chimes with when a lot of gold juniors started up and found new projects around the world,’ says Elizabeth Ferry, an economic anthropologist at Brandeis University who specialises in gold mines and markets.

Although Alba’s Welsh project is younger, by prioritising historical mines and their existing infrastructure, it’s also trying to cash in on the current gold price. ‘The original mine shut down in the 1990s because the price back then was US$300 an ounce,’ says Frangeskides. ‘When it touched on US$2,000 an ounce, it suddenly makes the economics of these projects a lot more palatable to investors.’ All projects hope to strike high gold grades; but arguably, what they really need to strike is good timing.

Rare and valuable

The return of UK gold mirrors other mining renaissances in the UK, such as renewed interest in tin, lithium and tungsten. However, unlike these metals, gold has no obvious increased industrial use. According to the World Gold Council, only around seven per cent of gold ends up being used in modern applications or technology. So why the effort to mine more?

This is an area that fascinates anthropologist Elizabeth Ferry, because ‘often it gets down to the thorny philosophical question of “what is value”’. She explains that, ultimately, the vast majority of gold is destined for central-bank deposits, private holdings or jewellery. ‘Really, its value resides in being kept, not used.’ Such keepsake value is partly due to gold’s past life as real currency; however, curiously enough, since the US unanchored gold from a fixed value of $35 per ounce in 1971, production has actually increased. Half the mined gold in the world has been extracted since then.

‘When we think of gold, we tend to think of the gold rushes of the 1800s,’ says Ferry. ‘But the pace and scale of modern gold mining in the past 50 years dwarfs that era.’ In other words, mining gold and hoarding it on such a large scale is almost entirely a modern phenomenon.

Ferry puts the production increase down to four main factors. First, advances in technology have made it easier to get at higher volumes of lower-grade deposits. Second, a lively gold market has emerged from shiny new financial toys such as gold exchange-traded funds, which have made the market at once more approachable to investors and more volatile. Third, she says, there’s significant demand for gold investment in Asia, particularly in India and China. And last, there is the haven argument – three economic crises in 50 years have justified the cost of taking new gold out of the ground.

Where is UK gold’s place in this? It’s hinted that Scottish gold will be used for jewellery and will certainly make an asset of its provenance. Alba’s Frangeskides says as much for Welsh gold: ‘It will probably be a collectible item.’ If most gold is valuable because it’s rare, Scottish, Welsh or Irish gold will be even more valuable for being even more of a rarity.

Gold detractors

Not everyone thinks mining this gold is a good idea. ‘The gold doesn’t benefit the local area,’ says retired social worker turned mine protester Fidelma O’Kane. It’s November and O’Kane has just spent 11 days in the Belfast office of the Department of Infrastructure looking over Dalradian’s latest addendum. The 100-page document was also available online, ‘but I prefer to look at a paper thing,’ she says. ‘I can get my head around how the changes might look on the hill when I have the maps in front of me.’

O’Kane leads the Save Our Sperrins campaign group, arguably the largest anti-gold-mining campaign in the UK. ‘I’m not usually the type that will go out there and talk about this or that issue,’ she admits, ‘but when the gold mine application started to go through and I saw how damaging it could be, I felt it was our duty to do something.’ When Dalradian first launched a planning application in 2017, Save Our Sperrins contested it on environmental grounds. ‘Our key concerns are the pollution threat to our air and water,’ O’Kane explains.

Dalradian’s plan is to develop on a hill in County Tyrone, around 12 miles northeast of the town of Omagh. The land is a mixture of tussocky grass and pockets of woodland where a portal to the bedrock already exists, as well as about a mile of tunnels. So far, conservationists’ fiercest complaints regard the tailings, or waste rock, that would be removed during the extraction. When gold is blasted from the rock face inside the mine, it needs to be crushed and separated from its quartz host. The crushed tailings would be left outside in a managed tailings facility, but there is concern that the tailings pile will leach heavy metals such as cadmium and mercury into the county’s water system. The campaigners are also worried that during windy periods, tailings dust could be blown over a large area of the county and create health issues.

‘The dispute has also shown us just how much rock needs to be wasted in order to gain access to relatively small amounts of gold,’ says O’Kane. Dalradian estimates that it will need to remove 511,000 tonnes of rock a year to get to four tonnes of gold. So far, the Department for Infrastructure has received 40,000 public comments on the project, 37,000 of them contesting it.

Snowdonia Society. ‘They are really significant parts of the region’s story.’ Although he stresses that Alba hasn’t yet submitted a planning application or conducted an environmental impact assessment, ‘there is a positive element of continuing a rich history, so long as that is balanced against the ecological and conservation duties of the national park,’ he says.

If gold can make us question the very idea of value, the process of opening a gold mine can do so even more. Back in the Cross Keys Inn, Roger Marr believes the return of gold mining could bring good things to Dolgellau. ‘Mining has been important here, why not bring it back to life?’ he asks.

One hundred and eighty-six miles away in Northern Ireland, near one of Europe’s richest gold finds, Fidelma O’Kane considers the question: ‘We’ve never had a gold mine here before, we take value from other things.’